ConclusionĮBITDA and adjusted EBITDA are two financial metrics that are often used to measure a company's profitability. Second, adjusted EBITDA does not reflect a company's cash flow, which is an important metric for assessing a company's financial health. First, adjusted EBITDA is still affected by a variety of accounting choices. What are the Limitations of Adjusted EBITDA?Īdjusted EBITDA is a more accurate measure of a company's operating cash flow than EBITDA, but it still has its limitations.

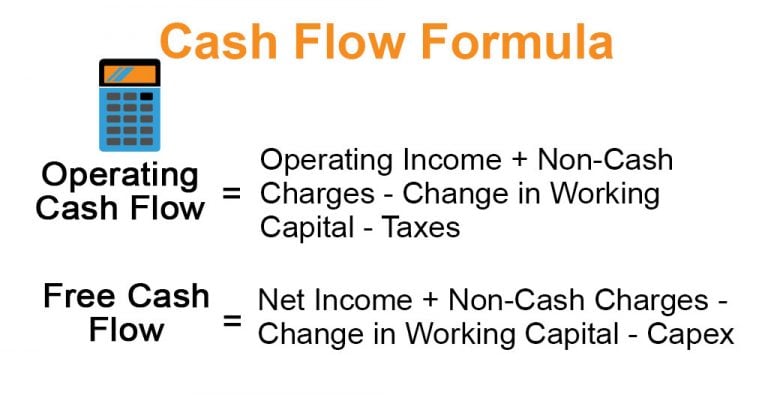

Finally, EBITDA does not reflect a company's cash flow, which is an important metric for assessing a company's financial health. Second, EBITDA excludes depreciation and amortization, which can be affected by a variety of accounting choices. First, EBITDA excludes interest and taxes, which can be significant expenses for some companies. The formula for calculating adjusted EBITDA is as follows:Īdjusted EBITDA = EBITDA + Adjustments What are the Limitations of EBITDA?ĮBITDA is a helpful metric for assessing a company's profitability, but it does have its limitations. These adjustments can vary from company to company, but they typically exclude items like one-time expenses, share-based compensation, and restructuring charges. The formula for calculating EBITDA is as follows:ĮBITDA = Net Income + Interest + Taxes + Depreciation + Amortization How is Adjusted EBITDA Calculated?Īdjusted EBITDA is calculated in the same way as EBITDA, with the addition of further adjustments to better reflect a company's operating cash flow. quarterly or annually) or on a cumulative basis. This can be done on a per-period basis (e.g. How is EBITDA Calculated?ĮBITDA can be calculated by adding back interest, taxes, depreciation, and amortization to a company's net income. Adjusted EBITDA is often used by investors and analysts to get a better sense of a company's true profitability. What is Adjusted EBITDA?Īdjusted EBITDA is simply EBITDA with further adjustments made to better reflect a company's operating cash flow. For this reason, EBITDA is often considered a more accurate measure of a company's true operating cash flow. Depreciation and amortization are also excluded from EBITDA, as these are non-cash expenses that can be affected by a variety of accounting choices.

What is EBITDA?ĮBITDA is an acronym for "earnings before interest, taxes, depreciation, and amortization." This metric is often used as a proxy for a company's operating cash flow, as it excludes non-operating expenses like interest and taxes. In this article, we'll take a closer look at the difference between EBITDA and adjusted EBITDA and how each metric can be used to assess a company's financial health. While EBITDA simply measures a company's earnings before interest, taxes, depreciation, and amortization, adjusted EBITDA makes further adjustments to this metric to better reflect a company's true operating cash flow. EBITDA and adjusted EBITDA are two financial metrics that are often used to measure a company's profitability.

0 kommentar(er)

0 kommentar(er)